When it comes to selecting a Group Hospitalisation and Surgical (GHS) insurance provider in Singapore, most HR professionals aren’t just looking for glossy brochures or branded wellness add-ons. They’re looking for reliability, fast claims processing, and a plan that makes sense for their workforce — whether that’s white-collar staff in the CBD or foreign workers in logistics or manufacturing.

We reviewed the most commonly used insurers for GHS in Singapore:

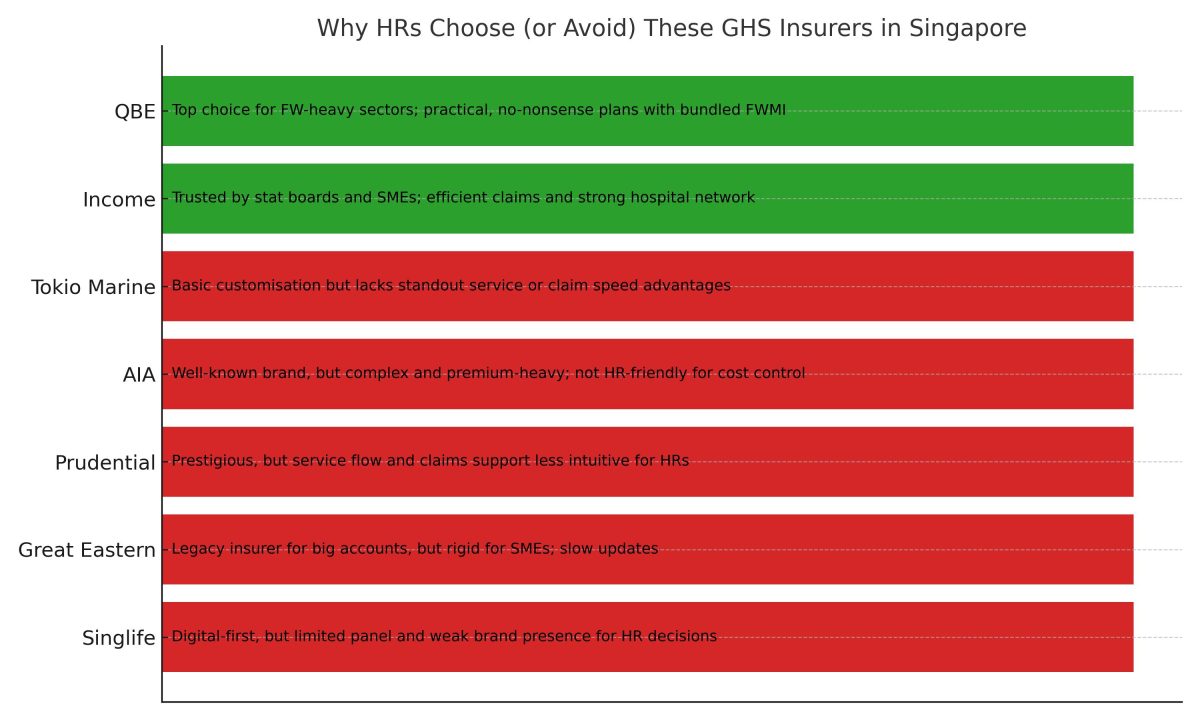

Income, QBE, Tokio Marine, AIA, Prudential, Great Eastern, and Singlife — and discovered a clear pattern:

HR managers consistently lean toward Income and QBE when they want coverage that won’t come back to bite them at renewal.

What HRs Often Ask (and Search) Before Choosing GHS

- Is the claims process going to be smooth — or a nightmare?

- Can the insurer cover our work permit holders too?

- Will the plan integrate well with existing HR workflows?

- Can I speak to a real person when things go wrong?

- Will next year’s renewal be a financial bombshell?

Income and QBE: What Makes Them HR-Friendly?

🟩 Income: The Stat Board Favourite

Income has long been the go-to insurer for government-linked bodies, SMEs, and HR teams who simply want peace of mind. What they like:

- Smooth claims at restructured hospitals (SGH, TTSH, etc.)

- Predictable renewals that won’t shock finance

- High employee trust – employees often know Income already from Shield plans

- Simple administration – HR teams don’t have to chase multiple platforms

One HR director we spoke to said:

“We never had to explain Income to staff. Everyone just gets it — and that matters when you’re onboarding 20 new hires at once.”

🟩 QBE: The Practical Pick for Foreign Worker Coverage

While less of a household name than Income, QBE is an HR lifesaver, especially for companies with work pass holders or high turnover.

- Seamless bundling of FWMI + GHS

- Clear, honest policy wording

- Dedicated account servicing for SMEs

- No overpromising — just good, solid coverage

One HR manager from a logistics firm put it simply:

“They’re not the flashiest, but QBE just works. That’s what we need when someone ends up at A&E.”

What About the Other Insurers?

| Insurer | Why HRs Hesitate |

|---|---|

| Tokio Marine | Customisable, yes — but doesn’t stand out in service or claims turnaround |

| AIA | Known brand, but often more focused on perks and wellness add-ons than core coverage |

| Prudential | Prestigious image, but not as nimble or HR-friendly in servicing |

| Great Eastern | Legacy systems and rigid structures — especially tough for SMEs |

| Singlife | Fast and digital, but weaker panel and HR still sees it as “the new kid” |

Bottom Line: What HRs Really Want

HR doesn’t want to impress — they want to avoid complaints.

When claims are delayed, when call centres are unreachable, or when plans are too rigid to adapt, the blame doesn’t go to the insurer — it falls on HR. That’s why so many choose Income or QBE. They’re not always the loudest in the market, but they get the job done with less drama.

📞 Ready to Review Your Group Hospital Insurance?

If you’re comparing GHS options for your team — especially if you’re managing foreign workers or SME payrolls — it might be time to explore what Income and QBE can offer.

👉 Let’s customise a quote that fits your team

Disclaimer:

This article is based on general market observations, public product summaries, and common HR feedback in Singapore. The views expressed do not represent the official stance of any insurance provider mentioned nor the article writer. Readers are encouraged to conduct their own due diligence before purchase.