Cargo Insurance is an insurance cover against physical loss or damage to the subject matter (the cargo) during transit (by air, sea, land rail, parcel post and/or courier) caused by perils which the insured has agreed upon.

Some Terminology which normally pops up when you discuss Cargo Insurance :

Incoterms

Incoterms stand for International Commercial Terms; is a set of internationally recognised definitions of international trade terms developed by International Chamber of Commerce.

The Incoterms tell the parties involved (seller and buyer) what they need to do in respect of:

a) Carriage of goods from seller to buyer; and

b) Export and import clearance

It also clarifies the distribution of functions, costs and risk relating to the transfer of goods from seller to buyer.

The following terminologies should be what you would normally be familiar with in Singapore courtesy of Muhammad Murad:

Ex-Works : One of the simplest and most basic shipment arrangements places the minimum responsibility on the seller with greater responsibility on the buyer. In an EX-Works transaction, goods are basically made available for pickup at the shipper/seller’s factory or warehouse and “delivery” is accomplished when the merchandise is released to the consignee’s freight forwarder. The buyer is responsible for making arrangements with their forwarder for insurance, export clearance and handling all other paperwork.

FOB (Free On Board) : One of the most commonly used-and misused-terms, FOB means that the shipper/seller uses his freight forwarder to move the merchandise to the port or designated point of origin. Though frequently used to describe inland movement of cargo, FOB specifically refers to ocean or inland waterway transportation of goods. “Delivery” is accomplished when the shipper/seller releases the goods to the buyer’s forwarder. The buyer’s responsibility for insurance and transportation begins at the same moment.

CIF (Cost, Insurance & Freight) : This arrangement similar to CFR, but instead of the buyer insuring the goods for the maritime phase of the voyage, the shipper/seller will insure the merchandise. In this arrangement, the seller usually chooses the forwarder. “Delivery” as above, is accomplished at the port of destination.

Transit Clause

Transit Clause is actually the insurance protection during the duration of the voyage. It could be from warehouse to warehouse or as determined by the INCOTERMS.

The commencement of the insurance usually starts from the time the goods first move from the warehouse onto the carrying conveyance for the purpose of commencement of the transit.

AND

The termination of insurance is upon Delivery of 1 of the following:

a) On delivery at consignee’s warehouse;

b) On delivery to place of storage elected for storage or for distribution;

c) Expiry of 60 days after completion of discharge from vessel.

WHICHEVER OCCURS FIRST.

TYPES OF CARGO INSURANCE

All risks cover as per Institute Cargo Clauses (A) or its equivalent for airfreight and inland transit modes of sending with named exclusions.

It covers the ‘risk’ loss and/ or damage that are:

i. ‘accidental’ and/ or

ii. ‘fortuitous’ in nature

or

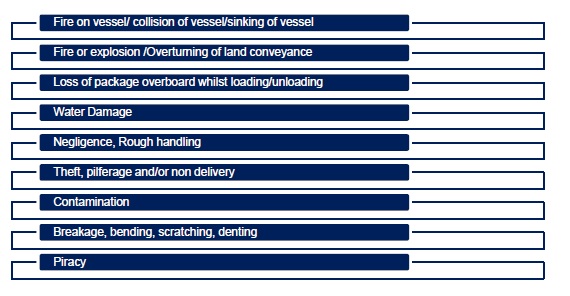

b) Named Perils (restricted cover), such as

Institute Cargo Clauses (B) with named exclusions

Institute Cargo Clauses (C) with named exclusions

Institute Cargo Clauses (A) “All Risk” Cover

Special Concerns for the above cover:

a) Used, reconditioned, second-hand goods

b) Personal and Household Effects

The above will call for separate rating and terms and conditions.

For a) and b) above, there may be pre-existing damages and/or defects such as dents , scratches, chipping marring which were there before our risk commenced. This will normally be excluded in the cover.

For a), they may be of an age where in the event of a need for repair, there may not be any more spare parts.

Exclusions:

– Wilful misconduct of the Insured

– Ordinary/ Natural loss in weight and/ or volume

– Insufficiency and/ or improper packing or preparation

* 1982 clause – strict exclusion

* 2009 clause – excluded if packing done by insured and/or packing done prior to commence of risk

– Inherent vice or nature of the subject matter

– Delay – even if delay is caused by peril insured

– Insolvency or financial default of the operator of the vessel

* Provided the Insured is not aware or should in the ordinary course of business that the owners, managers, operators etc were in financial difficulty

* Cargo was bought and assigned to buyer in good faith.

– Seaworthiness and fitness of vessel/container

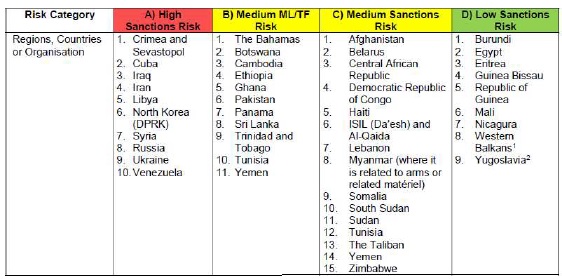

List of Sanction Countries

The part which you will like to know is probably :

What are the Underwriting Considerations?

Do get the following ready when you need a quote from us:

Insured – Experience and Loss Record

Cargo – Type of cargo

Packing – Crates or Cartons, Drums, Bags, Bare, Pallets

Mode of Shipment – Conventional or Container-ised

Bottom limit of Liability – Maximum sum insured per conveyance

Voyage – From where to where

Conveyance – Airfreight or Sea-freight

Estimated Annual turnover

OK, you are now armed with the knowledge of What is Cargo Insurance and if you are a trader of physical goods, it is definitely a MUST HAVE in order to get a good night sleep. Feel free to contact us for more details.

Back to the top of Cargo Insurance